The product was initially designed for treatment of blood cancer, but it is now hoped that its use can later be expanded to treatment of other types of cancer.

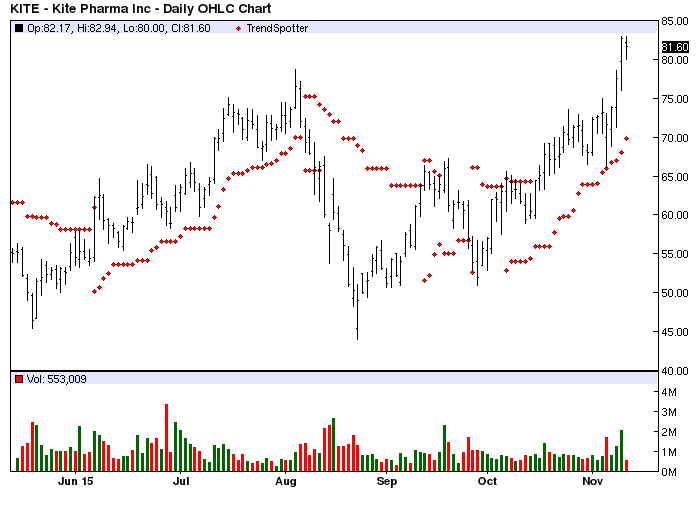

KITE PHARMA STOCK PRICE TRIAL

Kite Pharma is waiting for marketing approval of its first product, following a successful trial on 100 patients on a very abbreviated track for innovative cancer products. (TASE: MTDS), Harel Insurance Investments and Financial Services Ltd. (TASE: PHOE1 PHOE5), Altshuler Shaham Ltd., Meitav Dash Investments Ltd. (TASE: MORA) (which also bought shares on the market, and whose stake in the company is now worth over $100 million), The Phoenix Holdings Ltd. Among the investors in Pontifax that received shares in Kite Pharma are Menorah Mivtachim Holdings Ltd. The main Israeli beneficiary of the acquisition is the Pontifax fund, which invested $3.8 million in Kite Pharma at an early stage, but which distributed Kite Pharma shares worth $120 million to its investors. (NYSE: TEVA TASE: TEVA) (whose current value is not much more than the value at which Kite Pharma, a company with no products approved for marketing yet, is being acquired).Ī significant part of the technology on which the product is based was developed by Professor Zelig Eshhar of the Weizmann Institute of Science. He is also a former director at Teva Pharmaceutical Industries Ltd. The company was founded in the US by Israeli-American Professor Arie Belldegrun, who already has two exits to his credit. Kite Pharma has developed a new method for genetically engineering immune system cells, so that they will make a focused attack on the malignant tumor. The company value for the acquisition reflects a 29% premium on the market price. This is one of the biggest ever acquisitions of a company whose products have not yet been approved for marketing.

has announced that it will acquire US company Kite Pharma Inc., developer of personalized cancer treatment drugs, at a company value of $11.9 billion. Pharmaceutical company Gilead Sciences Inc.

Part of the technology was developed at the Weizmann Institute. Pontifax fund and Israeli institutional investors will profit from the US personalized cancer drug company's huge sale.

0 kommentar(er)

0 kommentar(er)