EXCEL DAILY EXPENSES TEMPLATE PROFESSIONAL

Professional Services Get expert help to deliver end-to-end business solutions.Technical Support Get expert coaching, deep technical support and guidance.Help Center Get answers to common questions or open up a support case.Smartsheet University Access eLearning, Instructor-led training, and certification.

Community Find answers, learn best practices, or ask a question. Learning Center Find tutorials, help articles & webinars. A quarterly roundup of the innovations that’ll make your work life easier. What’s up next A sneak peek at upcoming enhancements. Digital asset management Manage and distribute assets, and see how they perform. Resource management Find the best project team and forecast resourcing needs. Intelligent workflows Automate business processes across systems. Governance & administration Configure and manage global controls and settings. Streamlined business apps Build easy-to-navigate business apps in minutes. Integrations Work smarter and more efficiently by sharing information across platforms. Secure request management Streamline requests, process ticketing, and more. Portfolio management at scale Deliver project consistency and visibility at scale. Content management Organize, manage, and review content production. Workflow automation Quickly automate repetitive tasks and processes. Team collaboration Connect everyone on one collaborative platform. Smartsheet platform Learn how the Smartsheet platform for dynamic work offers a robust set of capabilities to empower everyone to manage projects, automate workflows, and rapidly build solutions at scale. Savings: emergency fund, RRSPs, RESPs, TFSAs, seasonal expenses (e.g. Personal: tobacco, alcohol, books, music, clothing and shoes, donations, subscriptionsĮating Out: meals, snacks, take-out, beverages (coffee, tea, juice, soft drinks)Įntertainment: recreation, sports equipment and fees, movies, concerts, hobbies, gamingĬhild: daycare, lessons and activities, allowance, school supplies and fees, babysitting, programs, tutorsĭebt Payments: credit cards, loans, leases, support payments, government debts, personal debt Health Care: medical premiums, life insurance, medication, eye care, dental, supplements, wellness costs Transportation: fuel, auto insurance, transit, parking, taxi, rentals, car sharing, tolls Living: personal care, bank fees, salon and spa services, dry cleaning, pet costs, memberships (fitness, clubs, associations) Groceries: food, baby needs, household supplies, toiletries Household: furnace, water tank, roof and gutters, decor, upgrades, storage locker, gardening, cleaning services, outdoor equipment and maintenance Utilities: phone/cell, cable/internet, gas, hydro, security Housing: mortgage, rent, strata fees, house insurance, property taxes View a sample of a completed tracker (from the previous version of our Monthly Expenses Tracker).Įxpense Categories – Know Where Your Money is Going

Community Find answers, learn best practices, or ask a question. Learning Center Find tutorials, help articles & webinars. A quarterly roundup of the innovations that’ll make your work life easier. What’s up next A sneak peek at upcoming enhancements. Digital asset management Manage and distribute assets, and see how they perform. Resource management Find the best project team and forecast resourcing needs. Intelligent workflows Automate business processes across systems. Governance & administration Configure and manage global controls and settings. Streamlined business apps Build easy-to-navigate business apps in minutes. Integrations Work smarter and more efficiently by sharing information across platforms. Secure request management Streamline requests, process ticketing, and more. Portfolio management at scale Deliver project consistency and visibility at scale. Content management Organize, manage, and review content production. Workflow automation Quickly automate repetitive tasks and processes. Team collaboration Connect everyone on one collaborative platform. Smartsheet platform Learn how the Smartsheet platform for dynamic work offers a robust set of capabilities to empower everyone to manage projects, automate workflows, and rapidly build solutions at scale. Savings: emergency fund, RRSPs, RESPs, TFSAs, seasonal expenses (e.g. Personal: tobacco, alcohol, books, music, clothing and shoes, donations, subscriptionsĮating Out: meals, snacks, take-out, beverages (coffee, tea, juice, soft drinks)Įntertainment: recreation, sports equipment and fees, movies, concerts, hobbies, gamingĬhild: daycare, lessons and activities, allowance, school supplies and fees, babysitting, programs, tutorsĭebt Payments: credit cards, loans, leases, support payments, government debts, personal debt Health Care: medical premiums, life insurance, medication, eye care, dental, supplements, wellness costs Transportation: fuel, auto insurance, transit, parking, taxi, rentals, car sharing, tolls Living: personal care, bank fees, salon and spa services, dry cleaning, pet costs, memberships (fitness, clubs, associations) Groceries: food, baby needs, household supplies, toiletries Household: furnace, water tank, roof and gutters, decor, upgrades, storage locker, gardening, cleaning services, outdoor equipment and maintenance Utilities: phone/cell, cable/internet, gas, hydro, security Housing: mortgage, rent, strata fees, house insurance, property taxes View a sample of a completed tracker (from the previous version of our Monthly Expenses Tracker).Įxpense Categories – Know Where Your Money is Going

This becomes the cash balance for the next week. If there’s a surplus, you should have money in your wallet or bank account. Total all columns and subtract actual expenses from actual income.On these pages, keep track of seasonal expenses rather than recording on your weekly pages. You also need to record weekly savings amounts on pages 14 – 15 of the Expense Tracker.You may want to track coffees, dining out, or fuel separately. You can then use the blank columns to create your own categories.

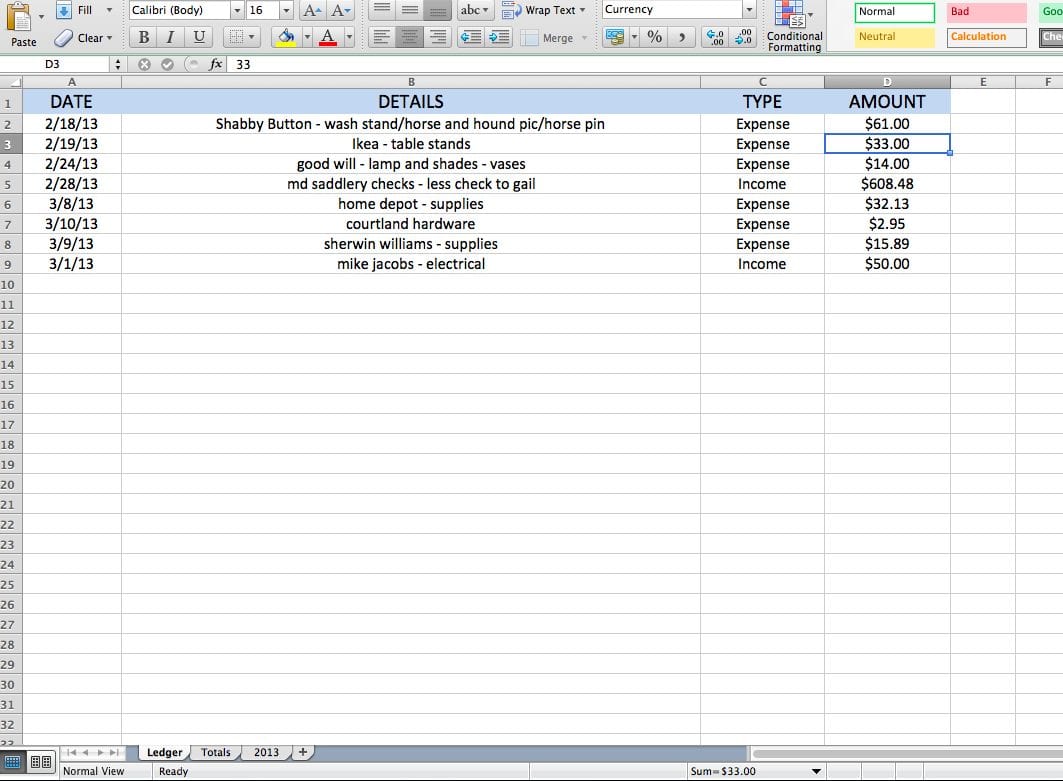

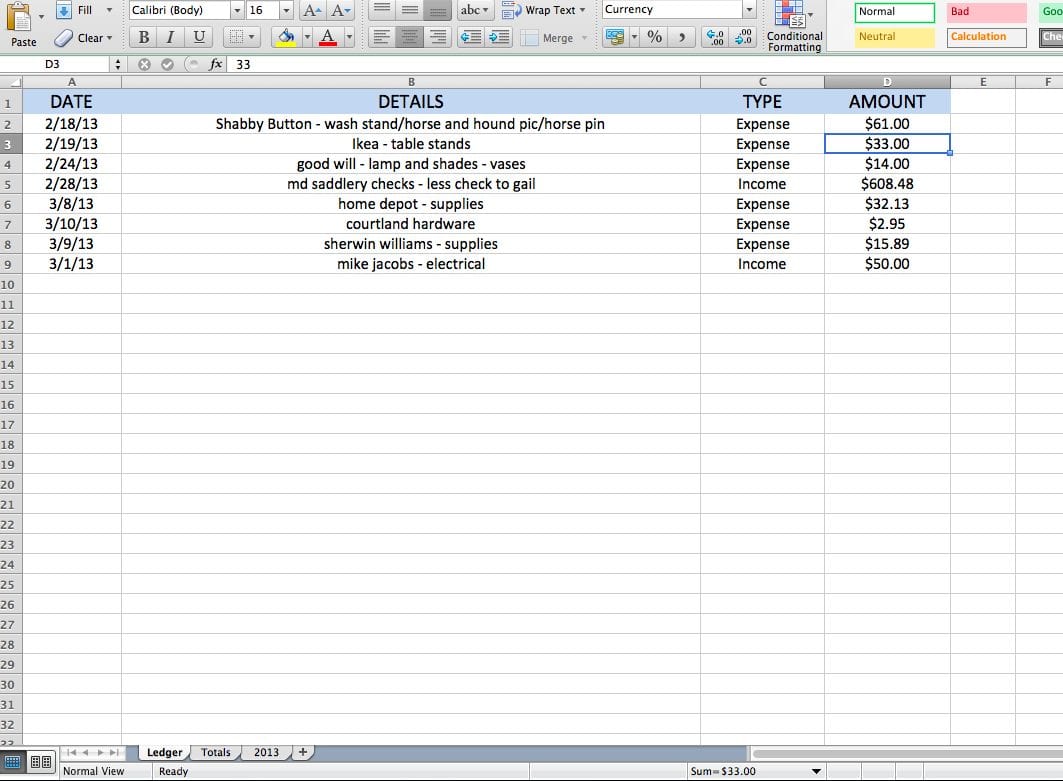

List the dates down the left side and record actual money spent each day.You should also list any income you may expect to receive during each week. Record cash balances on hand or in your bank account.For example, a 7 day tracking period would be March 30th to April 5th. For each week, record dates you are tracking.The expense categories listed further below and on page 1 of the Expense Tracker will help you decide which expenses to record where.Open a copy of our Monthly Expense Tracker.

0 kommentar(er)

0 kommentar(er)